I’ve been collecting and using credit card miles and points for air travel for decades now, and have gotten really good at it over the past few years. There’s no doubt that the best way to earn a ton of miles, fast, is by taking advantage of those enormous credit card sign up bonuses: some cards offer 30,000, 60,000, even 100,000 miles just for becoming a card member and making a minimum spend within a certain time period. We’ll talk about which cards offer the biggest sign-up bonuses soon, in a different article.

Sign-up bonuses aside, today I’d like to show you which cards earn the most miles for actual everyday spending. Often, after I attain the big initial miles bonus on a card, I’ll cancel it and move on. But there are a select few cards that I keep and use often; ones that bring in much more than the standard “one mile per dollar.” Today I will show you these secret weapons.

We all have different spending habits, so this may not be one-size-fits-all, but here is my ultimate recipe for earning the most miles through spending.

By the way, I’m not being compensated to refer these cards to you–these are truly my favorite go-tos. I carry and use them all. I may receive a points bonus for referring you though, so feel free to apply using my links below and we’ll both earn bonuses.

American Express Platinum: 80,000 bonus miles $200 cash back and 5X the Miles for Airline Flight Purchases

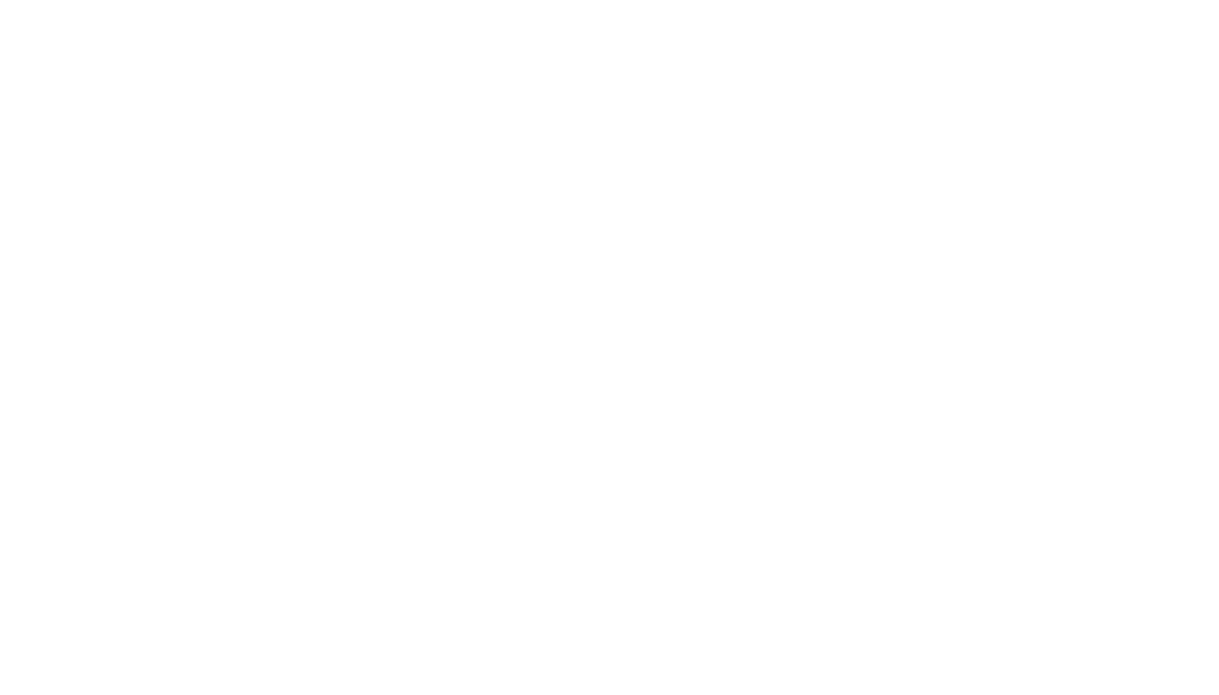

The American Express Platinum card is essential for anyone who is a frequent flyer. There’s one giant perk that makes the annual fee worth it: 5x the miles for flights booked directly through airlines. FIVE TIMES!!! That’s huge. Take for example, the fact that recently I had to book $13,000 worth of airfare for my company. I earned 65,000 miles just for booking the flights–enough for a one-way business class ticket overseas. That’s bananas! While I don’t often book $13,000 of airfare all at once, just spending $1,000 on flights with this card means you’d earn 5,000 miles before you even left the ground. Take a look at one of my recent statements below. Look at all the 5X earning bonuses:

I use the Amex Platinum card exclusively for airline travel, and remember, you must book directly through the airline. No bonuses when you book through third party sites like Travelocity or Expedia. But why would you do that anyway?

RAMBLIN’ TIP: Always, always, alwaaaaaays book directly with the airline. Saving a few bucks using a third-party travel site is never worth it. Please trust me!

Other perks on this card include a $15 monthly Uber credit and access to American Express Centurion Airport lounges, which I often take advantage of.

The annual fee is a little steep, but pays for itself if you fly often and make sure to utilize the card’s other perks. Use my referral link to apply HERE.

American Express Delta Skymiles: 90,000 mile sign-up bonus! 3X miles on Delta purchases, 3X hotels, and 2X dining

The 90,000 mile sign-up bonus is one of the best I’ve seen in a long time, but act fast – this offer expires March 29th. The card usually offers a 50,000 mile sign-up bonus. This is a major score for lots of miles, quickly. Apply HERE.

Chase Ink Business Preferred: 100,000 mile sign-up bonus. 3X the Miles for Travel, Shipping Purchases, Internet, Cable and Phone services, and Advertising Purchases via Social Media Sites

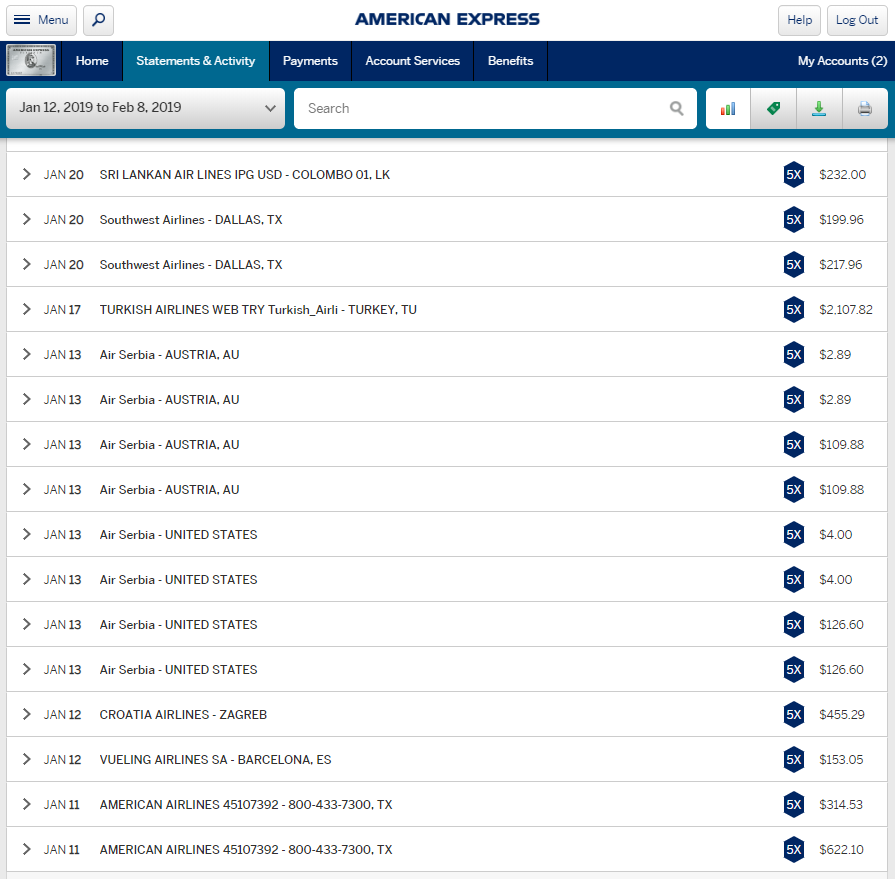

You have to be a business owner to score this one, but if you are, this is a must-have. I spent thousands with UPS last year, with every dollar earning triple the points. Same with social media: I advertise on Facebook a ton, might as well triple the rewards. I pay my cable and cell phone bill and use this card for hotel purchases, all earning 3X the miles. Look at all these bonuses!

In the statement above, you’ll notice I am being bonused for travel, cable TV, phone, Facebook ads and even my website server. I don’t charge anything on this card that isn’t part of its bonus categories. Note that sometimes I don’t see the 3X bonus on some eligible categories; when this happens, I call customer service and they correct it the missing points.

The Chase Ink Business Preferred also has one of the best sign-up bonuses around: 80,000 points as of this publication. You can apply HERE.

Capital One Spark Business: 2X the Miles for Everything Else!

I think I’ve pretty much mastered the mile-earning game when it comes to purchasing travel, cable, phone, shipping, social media, groceries, and restaurants…but what about everything else? Car repair, pharmacy, clothes, electronics, etc. I use Capital One’s Spark Business for all this stuff and everything else, earning me 2X points for anything and everything.

A few notes about using points and miles from these:

I have found the most valuable redemptions and smartest way to maximize these points is by transferring them to airline partners and then use them for business or first class flights. Sure, you can use your miles for coach seats, but you will squeeze much more value from your points when you use them for premium class seats. For example, a $700 one-way trip from LAX to Hong Kong in coach might cost you 25,000 miles. But an $8,000 ticket in business might only be 70,000 miles. See how much more you’re getting when you use your rewards to fly in the big chair?

Whatever you do, do not use them for statement credits, to buy electronics or even hotels. What a waste!

Good stuff! I have a similar system with Chase Sapphire Reserve, but you reminded me that I should consider getting back on the Amex train. I loved having the Platinum! Watching those 5x accruals was amazing.

The one place I’ve found VERY high value with economy redemptions is in Africa. Living in Ethiopia, 1-2 hours flights to Somalia, South Sudan, Sudan, and other neighboring countries can go up to $800 sometimes! Many 2-4 hours in the region can be $800-$1,000. By transferring points to my MileagePlus account, I can redeem on Ethiopian, giving me awesome trips for awesome value.

Thanks again Randy!

Heck yeah on the Africa redemptions…UA miles have been lifesavers! Especially the time I got stuck in Djibouti and then again (the very next day) in Hargiesa. Tickets out last minute were priced out at thousands and my UA miles saved my butt!!!

Same thing happened to me in Indonesia. I go sick. Had to rush home to San Antonio. No flight insurance. All flights were fully booked out of Indonesia to the United States for the next 2 weeks. My only option was to purchase a one way First Class ticket. The cost was about $8,000. I did not have the cash on me or in the bank. But I had in excess of 300,000 points/miles accumulated (most were $1 per point) on my American Express Gold Card Account (I would later upgrade to Platinum). But the card not only saved me money but saved my ass…literally.

I got sick (I did not go sick).